In the last week a 7:30 Report titled “ Experts say updated flood zone modelling could leave some homes ‘uninsurable” was aired.

The gist of the report is that Kensington Banks, 5 km from Melbourne CBD, has been rezoned to a flood zone. Property prices are expected to plummet by 20 percent. I think that’s rather conservative- who is going to buy in a flood zone? Unless it’s a developer who will raze it all to the ground and build a Smart Resilient complex.

The expert quoted is Karl Malin, CEO of Climate Valuation and Co Founder of The Climate Risk Group who owns climate model XDI (which was used in the report Uninsurable Nation- link to the article I wrote on the Uninsurable Nation at end).

Climate Valuation released a report this month titled “Going Under: the imperative to act in Australia’s high flood risk suburbs”.

Climate Valuation has used the highest risk scenario RCP 8.5 Scenario:

Why?

Even climate zealots state it was not intended to be used as a likely scenario:

IPCC modelling outlined

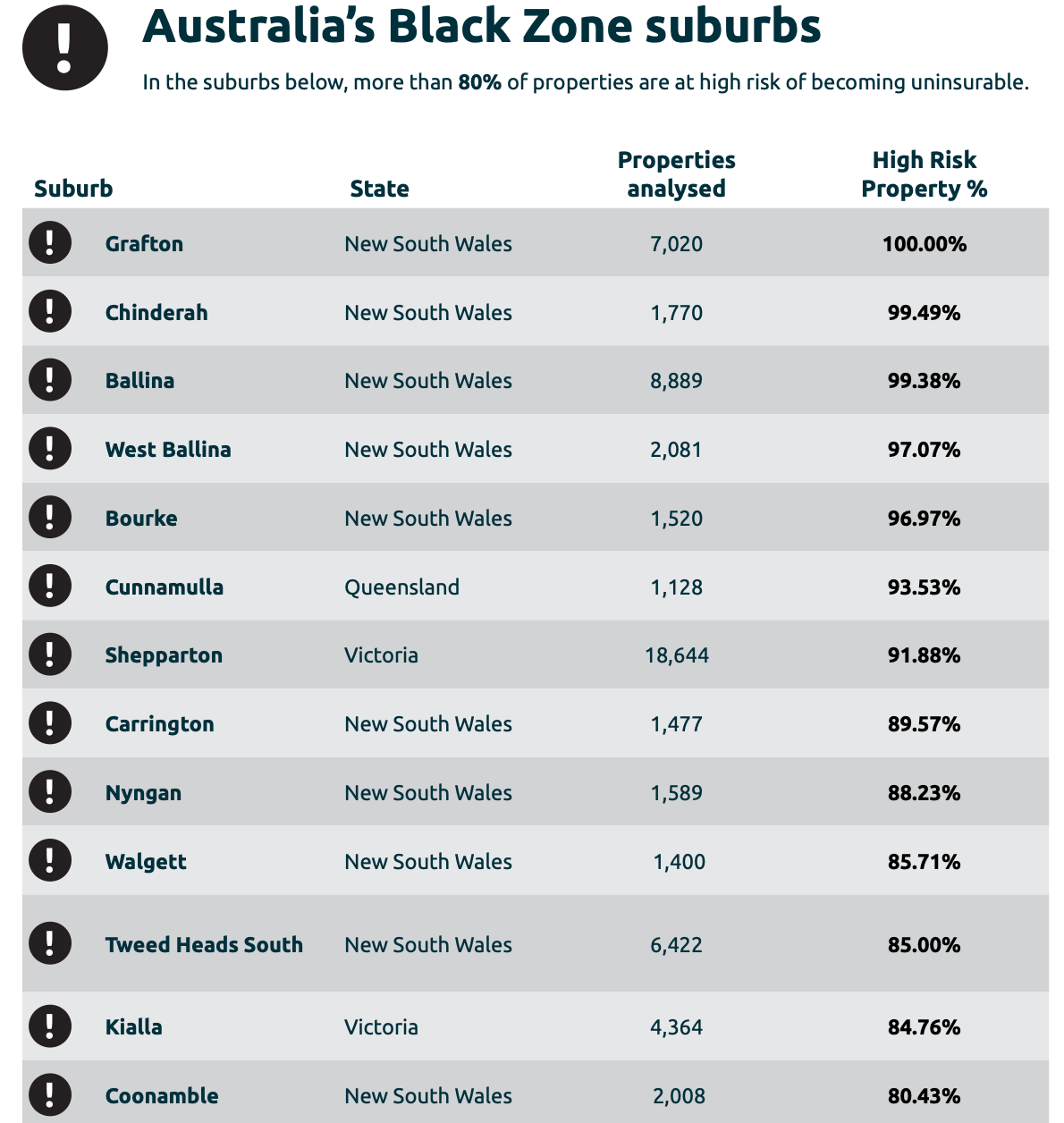

Back to the Going Under report. The cities/towns at risk are identified as either Black or Red zones:

Black Zones are identified as suburbs where 80 percent of houses are at high risk of becoming uninsurable for riverine flooding damage

Red Zones are identified as suburbs where 50-80 percent of houses are at high risk of becoming uninsurable for riverine flooding damage.

How are properties assessed as high risk?

High risk is assessed as a potential annual risk to house of 1 percent of cost of house (Uninsurable Nation gives a house price of $314,000 as an example- land is not included) and over for climate change. This means potential costs of $3,140 annually per year.

Specific houses are not assessed.

Different models are used to assess risks. The highest risk climate model for storms is used to assess flood risk, the highest risk climate model for drought is used to assess fire risks etc.

“…models are structured to provide a ‘stress test’ and alert property owners to the upper range of possible risks rather than average projections.” Does that sound problematic to you?

Disclaimer time: Putting out dire warnings whilst taking no responsibility for what might transpire with people losing homes:

And why focus on extreme modelling which the IPCC has said is implausible?

Coastal Ratepayers United in Kapiti New Zealand has been pushing back on their Council using RCP 8.5 to justify ocean rise projections, which will lead to managed retreat, uninsurable homes and inability to sell.

You can find more about their efforts here

Kapiti is under threat and the residents are mobilising:

There is no clear consensus about climate modelling

Guardian article “Trillions of dollars at risk because central banks’ climate models not up to scratch” quotes Professor Andy Pitman:

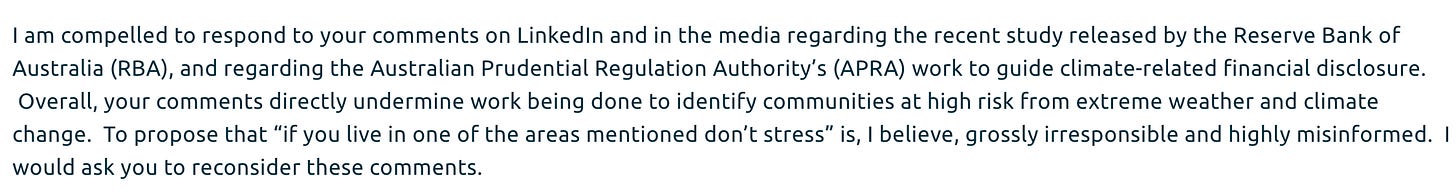

Climate Valuation CEO, Dr Karl Mallon didn’t appreciate Professor Andy Pitman’s concerns, and responded with a press release titled:

“An open letter to Professor Andrew Pitman – Director of ARC Centre of Climate Extremes”. Some excerpts:

N.B. Note that Shepparton Victoria is on the black list with 91.88% uninsurable properties. It will be interesting to keep an eye on the Smart City high speed rail project Clara, which pinpointed Shepparton as the first city they will build of their proposed 8 Smart Cities connecting Melbourne to Sydney.

A whole other swathe of Electorates were identified as being at risk of becoming uninsurable in the Uninsurable Nation report, and another swathe of Local Government areas were identified as being at risk of climate events in the NSW Disaster Mitigation Plan (I have three other articles on my substack covering this). Managed Retreat is well and truly on the horizon. Forewarned is forearmed.

1 in 25 Australian Homes Uninsurable by 2030

Interview with Jason Olbourne from TNT Radio where I discuss the information below: Full Video Here: https://tntradio.live/shows/weekends-with-jason-olbourne/ Thanks for reading Kate Mason! Subscribe for free to receive new posts and support my work.

The report from Karl Malin, CEO of Climate Valuation and Co Founder of The Climate Risk Group, is revealing:

“locations that modern technology and climate science now suggest could become unliveable”

Meaning that those newly declared mystical oracles, modern technology and climate science, are to be our guides. And

“The challenge therefore is not to find fault but to find solutions”

Meaning, no-one is to doubt the aforementioned mystical pronouncements.

This is going to sound naive and left of field but I’ve never insured my home. My insurance is my due diligence and contingency.

I live in a BAL 40 high fire risk zone. The value of the home is the life lived there the warmth and lives of the family.

I won’t have it measured in monetary terms. It’s the crudest and most pitiful of valuation.

Just another point of view.

They steal using fear and money