Interview with Jason Olbourne from TNT Radio where I discuss the information below:

Full Video Here: https://tntradio.live/shows/weekends-with-jason-olbourne/

The other day I was having a look at an article on the WEF website when this article caught my eye:

The WEF article goes on to say:

“Insurance crisis in Australia: a costly legacy

The report, Uninsurable Nation: Australia’s Most Climate-Vulnerable Places, says 520,940 buildings will be deemed “high risk”, having annual damage costs equivalent to 1% or more of the property replacement cost.

River flooding poses the biggest risk to people’s homes, according to the study. Of the properties classified as uninsurable by 2030, 80% of that risk is due to river flooding. Flash flooding and bushfires are the other main hazards contributing to properties becoming uninsurable.” https://www.weforum.org/agenda/2022/06/climate-change-australia-insurance-crisis/

This report was issued by Climate Council Australia.

https://www.climatecouncil.org.au/wp-content/uploads/2022/05/CC_Report-Uninsurable-Nation_V5-FA_Low_Res_Single.pdf?

They list the most at risk electorates:

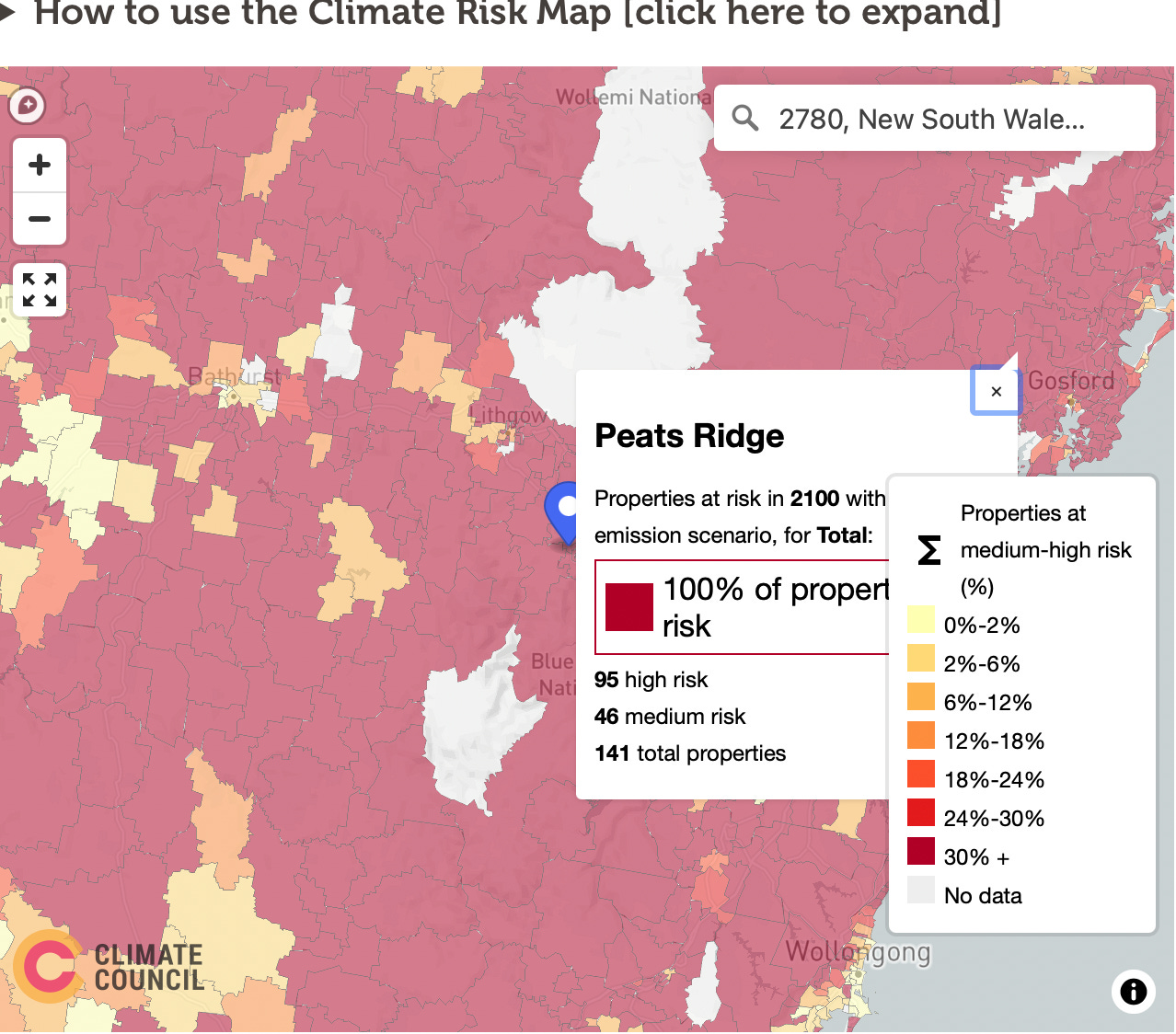

They have a map where you put your postcode in to to see how at risk your town/suburb is: https://www.climatecouncil.org.au/resources/climate-risk-map/

Here’s some examples:

You can see above that if your house was worth $350,000 and it was assessed that you needed to spend $3,500 per year on climate change repairs (what that would could include needs further research) your house is uninsurable. If your house was worth $350,000 and you needed to spend around $800 per year on climate change repairs (again, what does this include?) your house is termed as medium risk.

Note that your house could be assessed as low risk for climate change for each element, but combined this would take you in to the medium risk category.

Then read the report UNINSURABLE NATION: AUSTRALIA’S MOST CLIMATE-VULNERABLE PLACES https://www.climatecouncil.org.au/wp-content/uploads/2022/05/CC_Report-Uninsurable-Nation_V5 FA_Low_Res_Single.pdf?

1 in 25 homes uninsurable by 2030. The modelling is at a High Emissions projection.

What is a High Emissions projection?:

"This scenario shows extreme weather impacts in a high emissions scenario, in which the world fails categorically to address the climate crisis. It corresponds with a likely temperature range of around 4.4ºC by 2100."

The 4.4 degrees rise comes from the IPCC 2021 Climate Report.

"Under a high-emissions scenario, the IPCC finds the world may warm by 4.4 degrees C by 2100 — with catastrophic results."

What is the Climate Council's solution?

6. Support communities to ‘build back better’

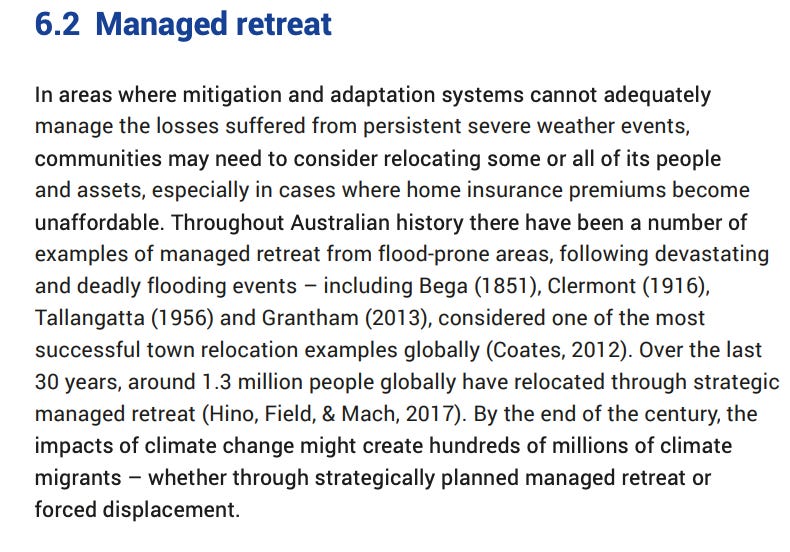

Towns, cities and communities must be rebuilt – where appropriate to do so – in a way that takes into account the inevitable future changes in climate and makes them more resilient. In some very high-risk locations, this may mean not rebuilding at all – managed relocations must be discussed as an option for some of the most vulnerable and exposed communities.

Managed Retreat in to Smart Cities- What will the rebuilding of towns and cities look like?

It is clear that this is "Resilient" Smart Cities. Everything hooked up to the internet and data collected, stored and used as modelling to dictate increasingly dystopian government measures of control and enforcement. Finding the information on climate change modelling and insurance has joined the dots for me regarding the enormous amount of pack and stack housing developments going ahead in Australia. They’re going to need to put us all somewhere when our houses are uninsurable and we have to sell them for a pittance.

I discuss the larger Smart City model here (my understanding has broadened since I gave this talk):

Once you start looking at the Climate Change Housing narratives you will see there are a large amount of groups, actors and reports spelling out the imminent necessity of removing people from their homes.

The Actuaries Institute Home insurance affordability and socioeconomic equity in a changing climate GREEN PAPER AUGUST 2022 solution is the Public Private Partnership Model https://actuaries.asn.au/Library/Opinion/2022/HIAGreenPaper.pdf:

“By acting today, policymakers can begin to address home insurance affordability and the socioeconomic inequities of climate change. We make the following recommendations for action. Importantly, these actions will require strong collaboration between multiple parties, including local, state and Commonwealth governments, insurers and banks, builders and developers, and First Nations Australians.”

What we are seeing in Australia is the Government opening the doors to Build To Rent housing developers, such as Blackstone. The largest Landlord in Australia, amongst other government funding of corporates to build properties we can rent from. I will unpack this further in a future post.

The Actuaries Institute solutions includes Managed Retreat:

And resilient housing and retrofitting existing houses make buying and maintaining a house increasingly unaffordable:

Towards the end of the Green Paper the following disclaimer is included:

Modelling can be incorrect, Modelling is based on assumptions, they can’t forecast the weather, data can be skewed etc. And this is where Australian’s need to pay attention. Has your insurance rates gone up in 2024? Have you asked your insurance company why? Most likely you will be told the rise is attributed to Climate Change. Ask them for the modelling they relied upon to assess risk to your property. Please share in comments when you receive the modelling.

We also have the Insurance Council of Australia https://insurancecouncil.com.au/issues-in-focus/climate-change-action/ proposing:

They work within the Public Private Partnership model and adhere to the United Nations Sustainable Development Goals

They also support the Natural Asset Market (as does the Actuaries Institute- everything is linked). It’s basically a model where every component of nature is given a price and a market is created upon it. Michael Swiz Swifte (from Wrong Kind Of Green https://www.wrongkindofgreen.org) discuss natural assets here- again NAC’s are for a future post- the SEC NAC proposal has been pulled back at the moment- but nature is still being valued and traded in other forms:

Looking at the NSW government climate change modelling

https://www.climatechange.environment.nsw.gov.au/about-adaptnsw/climate-projections-used-adaptnsw/other-climate-projections-available-nsw

https://www.climatechange.environment.nsw.gov.au/news/how-nsw-harnessing-power-climate-modelling

The NSW Government has a partnership with XDI. XDI is part of the Climate Risk Group. They state that Climate Change will lead to costly repairs, rising premiums and market devaluation.

https://theclimateriskgroup.com/

There are many Scientists speaking out against the Climate Change forecasts. Here are a few

https://judithcurry.com/2022/11/02/the-climate-crisis-isnt-what-it-used-to-be/?

https://www.sciencedirect.com/science/article/pii/S1674987123002414?via%3Dihub

https://judithcurry.com/2023/12/29/realistic-global-warming-projections-for-the-21st-century/

There are two groups in New Zealand pushing back against the climate forecasts for their area, leading to uninsurable properties and lack of new infrastructure in their town. CRU have funded their own scientific modelling for climate forecasts. They are very worth connecting to. https://www.cru.org.nz/?

You can listen to the two NZ organisations speaking about what is happening and what they are doing (and an additional interview):

https://realitycheck.radio/salima-padamsey-chair-of-the-coastal-ratepayers-united-on-why-kapiti-coast-property-owners-must-resist-the-councils-coastal-hazard-mapping/

https://realitycheck.radio/tanya-lees-on-the-kapiti-coasts-tense-community-consultation-with-coastal-advisory-panel-for-managed-retreat/

https://realitycheck.radio/sue-grey-on-managed-retreat-and-freedoms-nz-campaign-update/

What can you do?

Ring your home insurance company and ask for their climate modelling which justifies your rising premiums (please share their modelling on my comments).

Check out how the Climate Council has assessed your town in the climate change risk map. https://www.climatecouncil.org.au/resources/climate-risk-map/

Have a look for any government documents which detail climate change in your area and any intended changes.

Write to your local MP’s/ Councillors and ask what climate change strategies they are aware of that are imminent for your area. Ask what climate modelling the government is relying on and which corporations are involved.

Listen to the NZ commentary.

Talk to people in your community to raise awareness.

Communityvoiceaustralia.org will take this up as a project for 2024 so sign up for updates and get involved.

i thought you would be interested to learn about Lynne Taylor's localized united nations review https://www.commoncorediva.com/2024/02/01/localized-united-nations/ Since she did that she has shared her investigations into the Democratic World Federalists who drafted the One Earth Constitution for a One Earth Parliament in 1968. [the IHR's were secretly set up in 1969]. It took till 1991 to perfect it in it's present form as a supreme document for corporate globalisation, hence why they think it should replace the UN charter as their constitution. Check out her interview with Hrvoje Moric Feb 20th and 21st 2024 on tntradio.live

Thank you for all this great information.

And finally I’m hearing something about the Natural asset market. I heard quite a while back about this being a new registration on NY stock exchange.

I tried telling people the enormity of what this might present, but of course very few people were interested.

I will certainly be following this and trying again to spread the word.